A consumer class action lawsuit was recently filed against ConsumerInfo.com in federal court in California. ConsumerInfo.com is an Experian company that provides credit reports and credit score information directly to consumers.

A consumer class action lawsuit was recently filed against ConsumerInfo.com in federal court in California. ConsumerInfo.com is an Experian company that provides credit reports and credit score information directly to consumers.

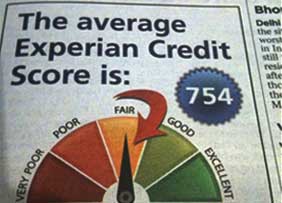

The complaint alleges that ConsumerInfo.com sells a credit score based on an in-house scoring system that is not sold to lenders and is not used by lenders, as actual credit scores are, in determining consumers’ creditworthiness. The lawsuit also asserts that advertisements at ConsumerInfo.com’s internet sites violate California consumer laws by misrepresenting that they offer a credit score used by lenders in determining consumers’ creditworthiness, failing to deliver credit scores used by lenders as advertised and failing to disclose to consumers the truth about what the company actually sells.

What this all boils down to, in my opinion, is that consumers want access to their FICO score from all three credit bureaus. Right now, consumers can access their FICO scores based on Equifax and TransUnion data from www.myfico.com, but there is no consumer direct option to obtain their FICO score based on Experian data.

[Related Article: 2011: The Year of the Free Credit Score?]

As background, there are three main credit reporting agencies in the U.S. (Equifax, Experian and TransUnion), and all three sell and deliver FICO scores to lenders who use the FICO scores in their credit decision processes. FICO (formerly known as Fair Isaac Corporation) is not a credit reporting agency, but rather works with each credit reporting agency to develop a FICO scoring system for each individual bureau.

FICO scores are the most commonly used credit bureau scores in the U.S. and it only seems logical (and fair) that consumers should have access to their FICO scores based on data from any of the three credit bureaus. In fact, there is precedence as consumers used to be able to access all three of their FICO scores until Experian terminated their agreement with FICO in February 2009 and barred myFICO from providing Experian based FICO scores and credit reports to consumers.

[Related Article: The Politics of the Credit Score]

I can’t help but think this outcome was (and still is) a great disservice to consumers. In fairness of full disclosure, I worked at FICO for 15 years and feel strongly that consumers should be granted access to the same information provided to lenders when making credit decisions. Without access to all three FICO scores, consumers are missing a vital piece of the puzzle in understanding where they stand in the credit spectrum.

At the end of the day, I can’t predict what the outcome will be with this class action lawsuit, or other activity focused on increasing consumer access to credit empowerment. In my opinion, it should be about consumer choice. Providing the consumer with information about the different credit score brands in the marketplace, letting the consumer decide which credit score is right for them and providing easy access to these scores and credit reports for a reasonable fee.

In the meantime, the only way consumers can currently get access to their FICO scores based on Experian data is from the lender via score disclosure notification regulations (Risk Based Pricing Notification and Mortgage Lending Notifications). While this is better than nothing, it would be much more valuable if consumers were able to see the score and report before applying for credit, affording the opportunity to improve their score and increase their chances of getting approved with the most favorable terms.

Note: The author is not a lawyer and nothing in this article should be considered legal advice or legal interpretation, and should not be acted upon without specific legal advice.

Image by u07ch, via Flickr

You Might Also Like

March 7, 2023

Credit Score

January 4, 2021

Credit Score

September 29, 2020

Credit Score