Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

A personal loan enables you to borrow a lump sum of money and repay it in fixed installments. While personal loans can be a useful tool, there are important factors to consider before taking one out.

According to recent statistics, millions of Americans have personal loan debt, with the average loan amount being $16,931. Personal loans can be used for various reasons, whether for debt consolidation, medical expenses, or home improvements. But how do you know if a personal loan is right for you?

Everyone’s financial situation is unique, so be sure to understand what to know about personal loans before you determine if it’s the best way to go. Here are seven things you should know before taking out a personal loan.

1. How Personal Loans Work

A personal loan allows you to borrow money and repay it in fixed installments. You can get a personal loan from banks, credit unions, or online lenders. Once you choose a lender, you’ll need to submit a formal application. When filling out the application, you’ll likely need to include identification such as your Social Security card, your address, and proof of income.

If your application is approved by the lender, you will receive a lump sum of money that you will repay in monthly payments plus interest.

2. Debt Consolidation Isn’t for Everyone

With increasing amounts of credit card debt, personal loans are becoming increasingly popular. Although personal loans are a common solution for debt consolidation, that doesn’t mean it’s right for you. Here are a few indicators that debt consolidation through a personal loan is not the best solution, and you’d be better off seeking debt counseling or another financial avenue:

- With your current financial pace, you’ll pay off your debt in less than a year. If this is the case, debt consolidation likely will not be worth it.

- You can’t afford the monthly payment. You don’t want to be stuck with an additional payment you can’t afford. This could lead to late payments or, worse, loan default.

- You will pay more interest and fees with a personal loan compared to your existing debt. You don’t want to take out a personal loan if it will cost you more money in the long run.

- Your spending isn’t under control, and you might rack up more debt after you pay off your existing debt. There’s no point in taking out a personal loan to consolidate your debt if it will just tempt you to accumulate more debt on paid-off credit cards.

- Your credit score isn’t good enough for an acceptable interest rate. You might want to take the time to improve your credit before applying for a personal loan.

Consider these statements and compare current debt costs to the costs of a personal loan to determine if debt consolidation is the best option. Also, note that not all personal loan providers are the best for debt consolidation. Some lenders specialize in debt consolidation, whereas others don’t have good enough offerings to make debt consolidation with their loans worth it.

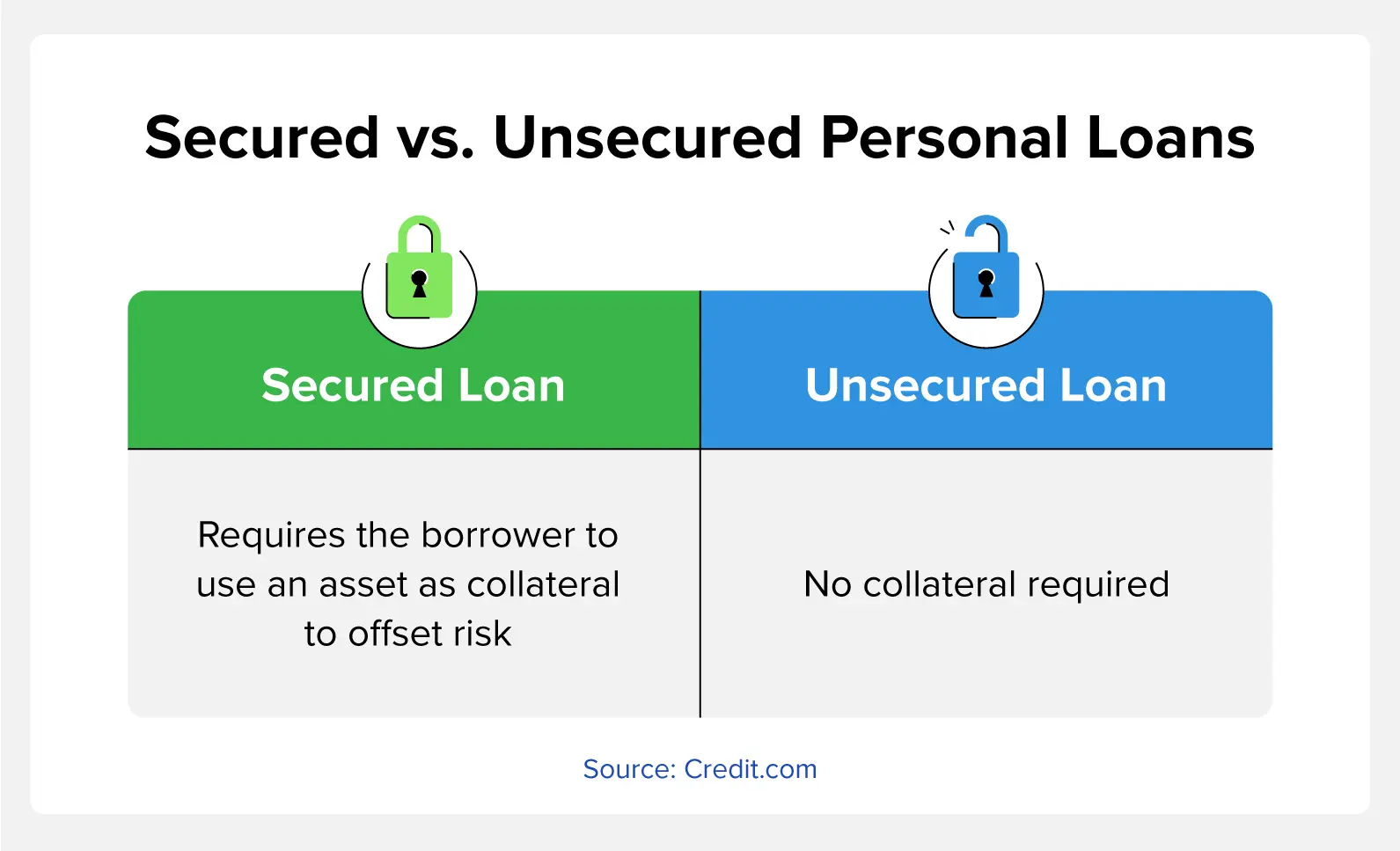

3. The Difference Between Secured and Unsecured Loans

Most personal loans are unsecured loans. This means you do not have to offer any collateral to receive the loan. Types of collateral include owned property, a house, or a car—anything the lender can use to pay back the money owed if you default on the loan.

However, not all personal loans are unsecured, and some lenders offer secured loans that require collateral. For example, if you have little to no credit or a poor credit score, lenders may only offer you a secured loan because your credit report isn’t a good enough indicator that you will repay the loan. If you don’t mind putting up collateral and intend to pay back the loan in full, secured loans don’t have to be bad.

4. Compare APRs Before Selecting a Lender

The annual percentage rate (APR) combines the personal loan interest rate and any additional loan fees, and it fluctuates based on the personal loan provider. APRs typically range between around 5% and 36%, and this is partly determined by your credit history.

Popular personal loan providers, such as Best Egg and Achieve, are known for low APRs, especially if you have above-average credit. However, if you have a good credit score and a loan provider is still requiring a high APR, you might want to consider looking into other options for a better APR. A bad APR could cost you hundreds of unnecessary dollars over the course of the loan.

5. The Impact of a Hard Inquiry on Your Credit Score

A hard inquiry is when a lender or creditor pulls your credit for the purpose of offering you a loan. This will ding your credit a minimal amount. The hard inquiry will remain on your credit report for up to two years, but it will likely stop affecting your score after one year. Plus, if you repay your loan on time and take care of your credit in the meantime, your credit will bounce back.

It’s also important to note that you should keep your loan shopping within a specific time frame. In other words, only apply for personal loans for two weeks to 45 days at the most. If it takes any longer, you might receive multiple dings on your credit report rather than just one.

6. The Max Loan Offer May Not Be the Best Option

Personal loans can range between $2,000 to $50,000, and some lenders, such as SoFi, offer as much as $100,000 loans. With that in mind, you may qualify for a large amount, but that doesn’t necessarily mean you should take the highest offer. Consult your finances and budget before deciding what personal loan amount to accept, because if you accept one for more money than you can afford, you will likely regret this.

Check Your Credit Score Before Applying

Most personal loan providers require at least a 640 credit score. However, some companies, such as Achieve and Upstart, offer loans to 620 credit scores and up. If you make your personal loan payments on time and responsibly handle your other credit responsibilities, a personal loan can improve your credit in the long run and immensely help your credit card utilization rate if you choose to use it for debt consolidation.

Before you determine if a personal loan is right for you, pull your credit first. With Credit.com, you can check your credit score for free.

You Might Also Like

March 8, 2021

Personal Loans

April 8, 2020

Personal Loans