I knew going into this adventure that I was dealing with a scam artist who was trying to cheat people out of their money by tugging at their puppy-loving heartstrings. See, I’d written a piece about this scam just a couple of weeks ago after a woman in San Diego almost fell prey to it.

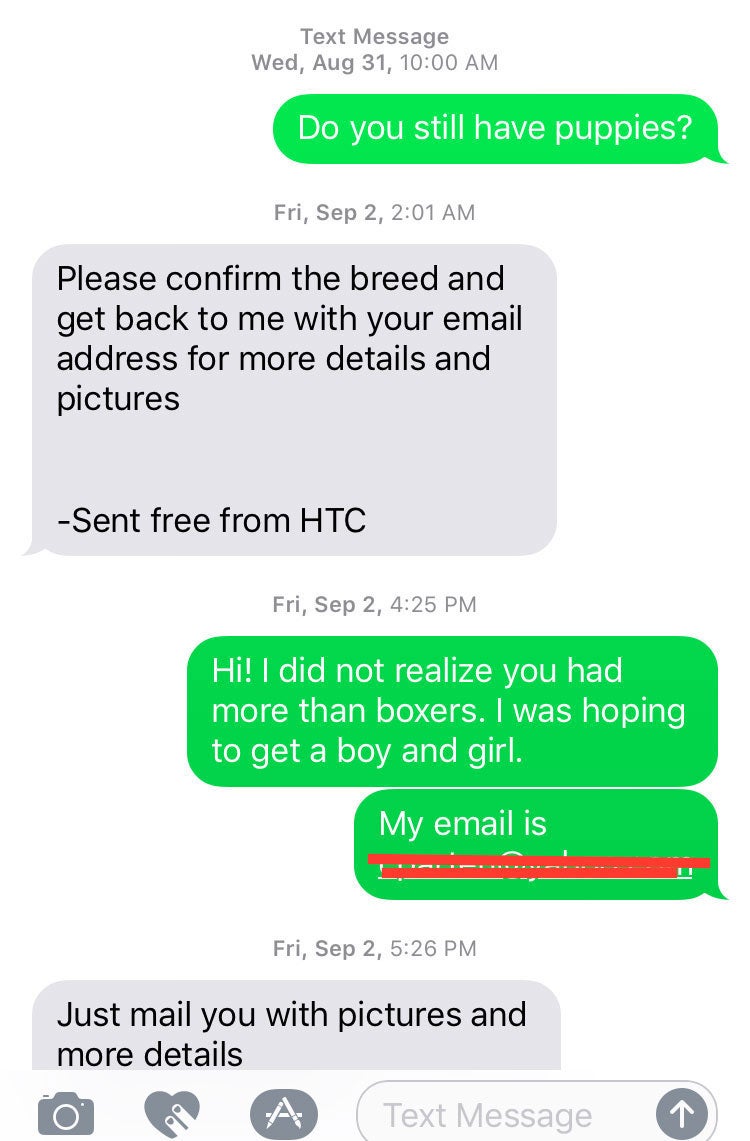

While researching that story, I decided to send a text to the phone number the scammers had used in multiple eBay ads, saying they had adorable puppies named Roxy, Ricky, Rose and Tina (they had ads for at least Old English Sheepdogs and Boxers, all by these names, and were advertising them in San Diego, Baltimore and possibly other areas). The fraudulent sellers had already pulled the ads from eBay after their con was spotted by the woman in San Diego, but a few days after I sent my text inquiring if the pups were still available, I got a response.

Here’s how it went:

Now, as I said, I already knew these folks weren’t on the pup up-and-up. I knew they were going to try to con me out of my money. The ridiculously low price for the “AKC-registered” puppies — just $320 each — was the first clue this wasn’t going to be a legit transaction.

There were more clues in their text. First, “please confirm the breed.” These folks were advertising that they had to get rid of their beloved puppies because of a recent move (thus the deep discount), not because they were breeders. Second, “just mail you with pictures.” Their English was a little faulty, which isn’t always an indicator in and of itself, but it’s something to watch for if you’re suspicious of an online transaction, as a lot of these folks operate from outside the country and English is not their first language.

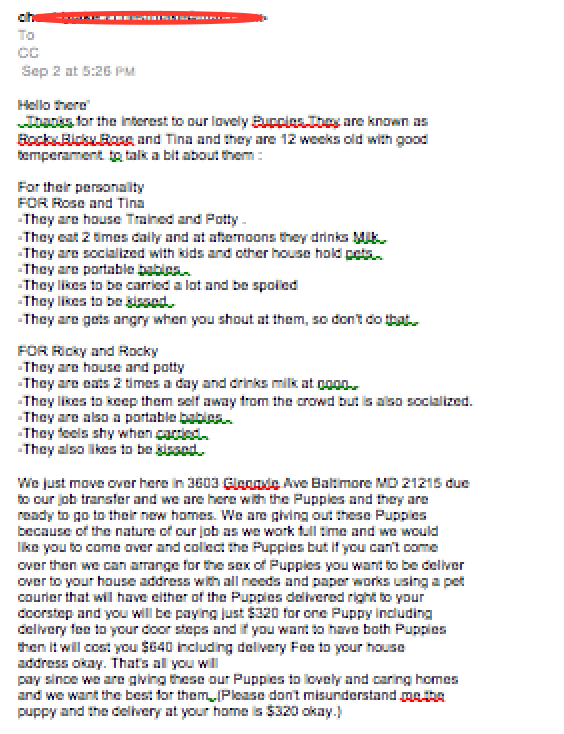

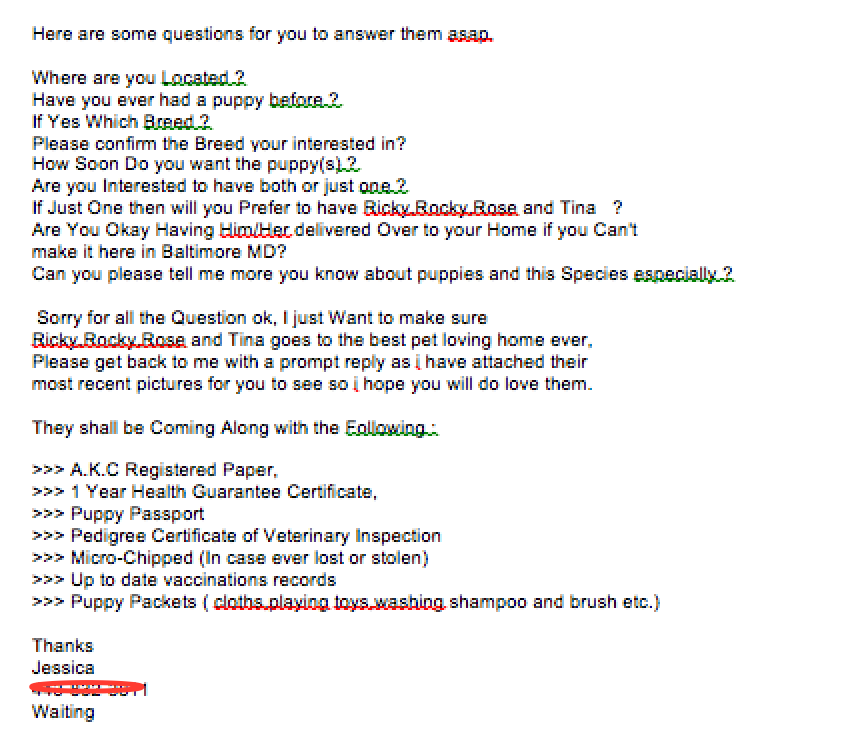

Their first email came with a dozen or so pictures of the puppies, plus some questions so they’d know if I’d be a good caregiver. And, of course, the language issues continued.

And, to get me emotionally connected, they asked me some more or less legitimate-seeming questions:

After I answered all the questions and apparently passed muster for being able to provide a loving home, the scammers said they were arranging shipment of the pups, their toys, all their paperwork, etc., and they asked me to wire them the money through Western Union so they could get that process started: Bingo. They wanted me to transfer the money to them in a way that is not easily traceable and for which I would have no recourse if they didn’t deliver the pups. As Western Union says on its website, “Western Union money transfer is the best way to send money to people you know and trust.”

Bingo. They wanted me to transfer the money to them in a way that is not easily traceable and for which I would have no recourse if they didn’t deliver the pups. As Western Union says on its website, “Western Union money transfer is the best way to send money to people you know and trust.”

But not strangers. Never, ever strangers. Why?

“If you send money to someone you do not know, you run the risk of fraud. Be cautious when a stranger asks you to send money,” the Western Union warning continues. “If you are sending money to a stranger or unknown person requires you to pay this way for goods or services before their delivery (especially offers on the Internet), for transport or insurance, payments as deposit to secure a lease for housing which you have not seen, allow payment of winnings in a lottery or betting, you run the risk of losing money. If still such a transfer is sent, you do so entirely at your own risk. Western Union is not responsible for the correct and proper delivery of goods or services paid through transfers under the brand Western Union.”

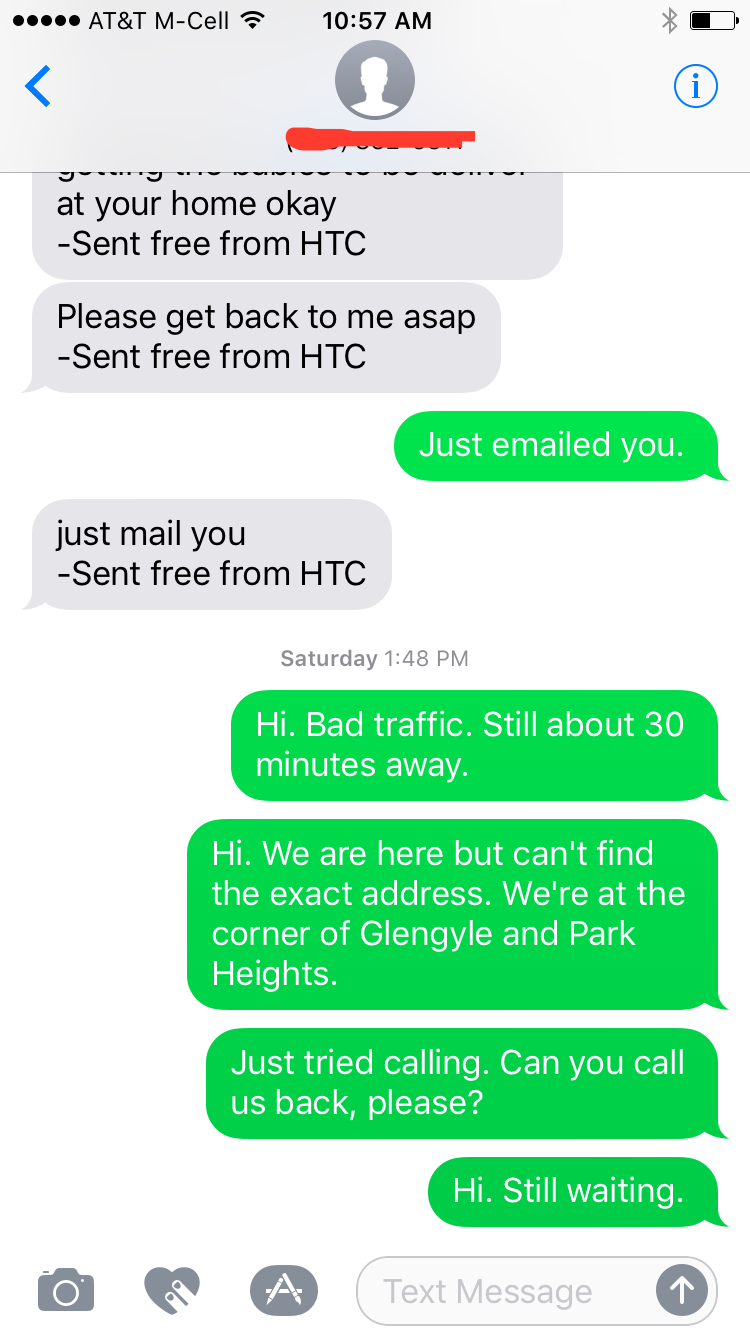

I told the “seller” via email that I was uncomfortable doing a cash transfer, but I’d be happy to pick up the puppies personally since I lived so close to Baltimore (which I don’t, actually). They said they had to leave at 4 p.m., but that they’d be happy to let me pick up the puppies at their address that didn’t actually exist. I feigned ignorance of that fact and told them I’d be driving to them soon. Of course, when I “arrived” they were nowhere to be found.

And, not surprisingly, almost a week later, I’m still waiting.

The bottom line is, never, ever give cash to an online seller for goods undelivered. Always use websites you trust, and never give out any personal information that isn’t a matter of public record. And even then, be wary. Also, if you ever do meet someone to exchange goods, it’s safest to take someone with you and let at least one other person know where you will be and what time you should return.

Fortunately for the people who fall for these kinds of cash-transfer scams, they’re most likely only out the cash they gave away, and it won’t impact their credit. Where the really serious damage from scams can occur is when your identity is stolen or your credit cards are compromised.

If you think you may have fallen for a scam that has compromised your bank or credit card accounts, it’s a good idea to check your financial accounts, credit reports and credit scores frequently for any signs of trouble. Transactions you don’t recognize, unfamiliar entries on your credit report and sudden changes in credit scores are signs of fraud to be immediately addressed. You can check your financial information through your bank or credit union’s online tools. You can keep an eye on your credit by viewing two of your credit scores for free on Credit.com and requesting a copy of your free credit reports by visiting AnnualCreditReport.com.

Image: Dusko Jovic

You Might Also Like

October 19, 2023

Identity Theft and Scams

May 17, 2022

Identity Theft and Scams

May 20, 2021

Identity Theft and Scams