We’ve written a lot recently about the disappearing starter home. A combination of rising prices, aggressive investors, and flat incomes are turning America into a nation of renters … and making things very hard on young people just starting out.

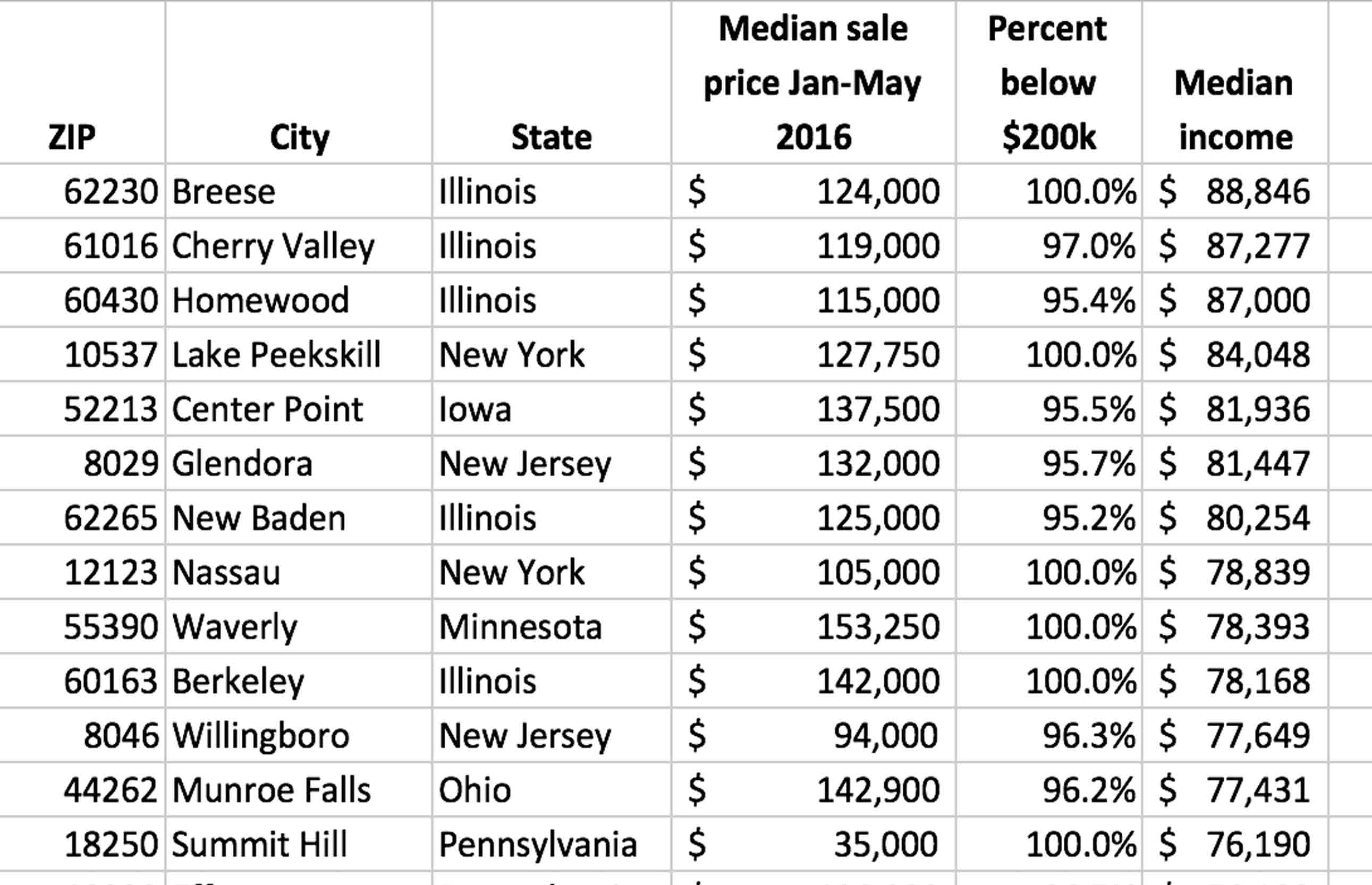

But there are still communities where plenty of starter homes are for sale — hundreds of them, around the country. Working with data provided by RealtyTrac, Credit.com has crunched the numbers and developed a robust list of ZIP codes where nearly all homes cost less than $200,000, well below the national median list price of $250,000. In fact, there are 515 ZIP codes in the U.S. where at least 95% of homes sold between January and May this year were under $200,000, according to the data. (And more than 1,000 where at least 90% were sold for $200,000 or less).

Price alone doesn’t indicate affordability, however. In some places, $200,000 sounds ridiculously cheap; in others, it’s out of reach even for folks earning more than the local average. So we fine-tuned the list by requiring that the local median income was 125% of the national median income ($53,657). In other words, we found places with cheaper-than-average homes and higher-than-average incomes.

And even by those high-income standards, there are still more than 60 places in the U.S. — most east of the Mississippi — where the vast majority of homes sold cost under $200,000.

Places like Magnolia, Delaware, near Dover, make the cut. There, the median sale price this year has been around $162,000, while the median income is around $74,000. And Manchester, Pennsylvania, near York, with homes selling for close to $129,000, and incomes are at around $73,000. Racine, Wisconsin, made the list, too (homes about $97,000, incomes about $67,000). Smaller towns near Chicago, St. Louis, Detroit, and Philadelphia are also on the list.

“Certainly the list is a demonstration that there are plenty of affordable housing markets in the country, just most of them east of the Mississippi. Maybe the message from this is ‘Go east, young homebuyer,'” said Daren Bloomquist, vice president of RealtyTrac.

As you look at the list, here’s a general rule to keep in mind. Places were the ratio of home price to income is greater than 4 begin to become unaffordable, while a ratio of 3 would be considered very affordable. So if median prices are $225,000, but income in $53,000, the average earner is going to struggle to buy a home. On the other hand, if homes cost $150,000, but incomes are $50,000, that’s pretty attainable for the average-paid worker.

All hope is not lost for sub-$200,000 home seekers out West, however. If you dial down the criteria, more sub-$200,000 places appear all across the U.S. — even in California. For example, if you expand the list to include ZIP codes where only 75% of home sales were sub-$200,000, but maintain the 125% income standard, 648 ZIP codes fit the bill. Most are still in the East or the South. But Pueblo, Colorado, makes the cut ($129,000/$73,000). So does Bakersfield, California ($160,000/$73,000) So, by the way, does Pittsburgh ($142,000/$72,000), a place we’ve written about before in our Real Cost of Living series as does Hebron, Ohio, near Columbus, which we’ve also spotlighted ($143,000/$68,000).

All income data, was taken from the 2014 U.S. Census.

Here’s 25 of the 61 ZIP codes that make the list.

Remember, having a good credit score can make buying a home more affordable — it’ll help you qualify for the best interest rates, so it’s a good idea to see where you stand if you’re looking for a mortgage. (You can view two of your credit scores, updated every 14 days, for free on Credit.com.)

More on Mortgages & Homebuying:

- Why You Should Check Your Credit Before Buying a Home

- How to Find & Choose a Mortgage Lender

- How to Refinance Your Home Loan With Bad Credit

Image: solstock

You Might Also Like

December 13, 2023

Mortgages