Are you saving up to buy a home down the road? It makes sense from a personal financial planning perspective, but when it comes to whether it actually helps you get your foot in the door, you may want to reconsider.

Why? In most cases, your ability to save is going to be at a much slower pace than the rate of appreciation of homes around your area. Put simply, if home prices in your area are on the rise, or interest rates go up, you may need to double or even triple how much you save on a monthly basis to keep up. In this case, time is money — the longer you take to save more money, it may just go toward offsetting a higher housing cost when you do finally pull the trigger, rather than lowering housing costs as most might think.

If you have nothing for a down payment at this time, it makes sense to continue to save. However, if you do have the cash now, the numbers may work in your favor. Let’s go back in time a bit to see how this works: Say you purchased a home in 2010 in Sonoma County, Calif., with an FHA loan at 3.5% down. The home value/purchase price back then was $275,000 and you put down $9,625 at closing, the minimum FHA contribution needed.

Fast-forward to July 2013. Assuming you took out a 30-year fixed rate mortgage, and diligently paid down your principal and interest each month (since 2010) while the economy gained momentum. At this point you would have accumulated at least 20% equity just by getting your foot in the door. Your mortgage would have been paid down to approximately $255,000 and you would’ve accumulated enough home equity by virtue of the amortization balance pay-down to have an opportunity to refinance.

Fast-forward to now, 2015. Housing prices have continued to rise based on real demand vs. supply (not an inflated market created by credit products pre-2007), and now you probably have 40% equity or more in your home, giving you a bigger chance to refinance your house — if you didn’t back in 2013.

Can You Afford to Buy a Home in 2015?

As the economy continues to improve, driving housing demand, the answer is yes, you can. While there is no crystal ball to say for certain what the future holds, consider that if prices continue to rise, homeowners would benefit by the consistent monthly increase in lendable home equity. This equity can be used to reduce your mortgage payment or switch to a shorter fixed-rate term in an effort to pay off the mortgage faster when refinancing.

If you have at least 3.5% of the purchase price to buy a house — or more conservatively, 5% of the purchase price — you can probably make a good case for buying a home, knowing that you’re likely to continue to accumulate equity.

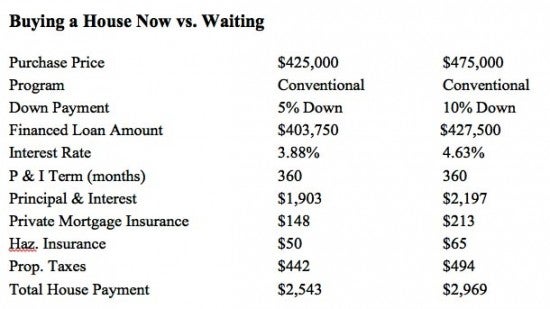

Keep in mind, this scenario assumes house prices continue to go up. It represents what the numbers would look like if you were to buy a house with today’s interest rate and housing environment with 5% down, assuming a price of $425,000. Or, if you decide to wait until you’re more comfortable with a 10% down payment, assuming housing prices continue their upward momentum and interest rates follow suit by trickling up, housing will cost more. A $425,000 house today could cost you $50,000 in purchase price for that exact same house and $426 per month more in mortgage payment — even by forking over more cash by the time you have it.

Other Factors to Consider

- Private mortgage insurance (PMI) is a lower factor on loans $417,000 or lower

- If the loan amount exceeds $417,000, 10% down is needed for a conventional loan; however, it’s still 3.5% for FHA

Even with more skin in the game in the above scenario — notice the change in private mortgage insurance (PMI). The property taxes would also be higher, again pointing to a potential higher future cost of housing.

The point is, if you can afford a mortgage payment with today’s home prices and interest rates and you have at least a 5% down payment (or 3.5% FHA), as well as money for closing costs, it might better serve you to purchase a house while you can before the same house in the future costs you more because you’re simply electing to put more money in when it might not be necessary. Moreover, if this scenario plays out, you could always refinance your house in the future to take advantage of the additional equity accumulation on a conservative fixed-rate principal and interest mortgage.

Weigh your options, and also consider how much house you can afford — and how much money you could save in the long run. Coming to the table with good or excellent credit can give you access to better interest rates, which will also save you money in the long term. You can get your credit scores for free at Credit.com to see where you stand, and to determine whether you need to work on building your credit beforehand.

More on Mortgages & Homebuying:

- Why You Should Check Your Credit Before Buying a Home

- How to Refinance Your Home Loan With Bad Credit

- How to Get Pre-Approved for a Mortgage

Image: iStock

You Might Also Like

December 13, 2023

Mortgages