How much credit card debt is too much? There are two ways to look at this question: in terms of your financial health or in terms of your credit scores. Th answer can be quite different depending on which question you are trying to answer.

When it comes to your credit scores, the question of how much credit card debt is too much often surprises people. A small balance can impact your scores in a big way, and similarly a large balance may not have that much of an effect, if your credit limits are also large.

I recently spoke with a friend who carries no credit card debt; she pays her card off in full each month. She also happens to monitor her credit score, and noticed it had recently dropped quite significantly. One of the main reasons listed for her current number: Her balances are too high in comparison to her credit limit.

She wondered why her credit card balances would be a problem since she pays what she charges in full each month. I explained that the credit score compares her balances to available credit limits, and the balance an issuer reports is often based on the amount due when her billing cycle ends, not after her payment is received. She quickly saw the problem. It turns out her her credit report lists only one open credit card with a $1,000 limit, and the balance most recently reported was $800 — the amount she had charged that month. By that measure, she is using 80% of her available credit.

So even though she doesn’t really have debt, her credit card “debt” is hurting her credit!

Here’s another example from someone who does have credit card debt:

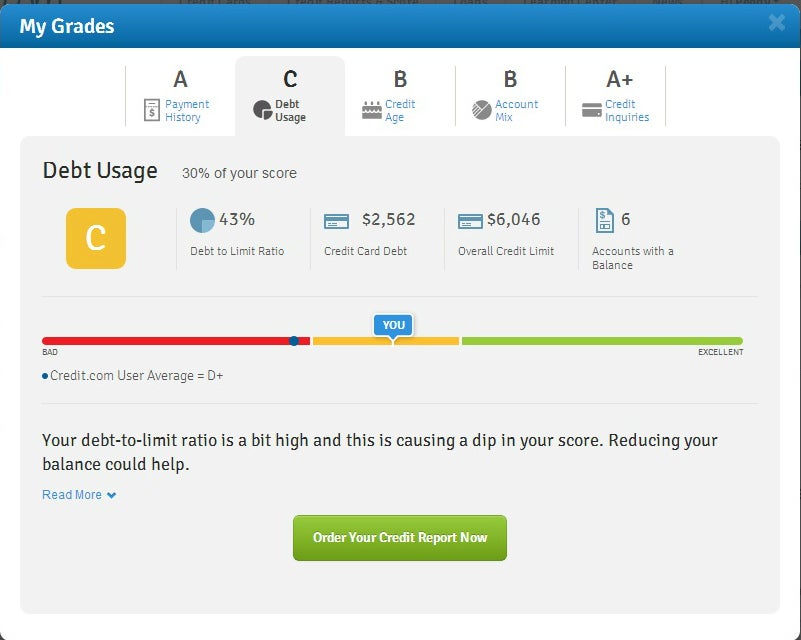

Peggy’s total credit limits are $6,046 and the balances reported on her credit cards are $2,562. She is using 43% of her available credit. As a result the “debt usage” factor that makes up about 30% of her credit score is only a “C” and that’s one of the main contributing factors to her total credit score of 713.

But if she can reduce her balances to 10% of her available credit, she should be able to bump up her score significantly — to just under 750 — in just six months. To do that, the action plan in her Credit.com account says she’ll need to pay an additional $326 per month.

If that’s more than she can afford to pay toward her debt, she can shoot for a more modest goal — say, $175 more a month, which could boost her scores to an estimated 736 in that same six-month period.

In terms of financial health, when you are trying to figure out if you have too much credit card debt, you want to look at two things: how long will it take you to pay off your balances, and how much will it cost you to do so? If you have debt at a very low interest rate — perhaps even at 0% due to a balance transfer promotion — then it’s simply a matter of budgeting to pay off the debt before the higher interest rate kicks in. But if your interest rates are higher, you may not realize how much that debt costs you each month.

For example, take a credit card with an interest rate of 22.9% and a balance of $4,600. The minimum payment is only $137 but the interest charge is $91. That means a large share of the payment is going to the card issuer in the form of interest. When you make that payment, are you aware of how much of it is going to the card issuer, and how little is going toward the purchases you have made?

Rules of Thumb

Here are some rules of thumb for figuring out if you have too much credit card debt:

- On your credit card statements, you will find the amount you must pay each month to pay off each card in three years. Can you consistently pay that amount each month until the debt is retired, without taking on more debt? If not, then you may have too much debt and may benefit from debt consolidation or credit counseling.

- Check your free credit reports. Are the balances on any of your cards greater than 20% to 25% of the available credit? (Get that number by multiplying the credit limit by 0.2 or 0.25.) If so, you may very well see a boost in your credit score if you can find the money in your budget to pay those balances down.

- Get your free credit score from a service such as Credit.com that also explains what factors are impacting your score. See what grade you earn for the “debt usage” factor in your credit score. If your grade is less than an A or B, you may have too much debt. But that grade comes with a recommended action plan to help you regain control of your finances and credit scores.

More on Credit Reports and Credit Scores:

- The Credit.com Credit Score Learning Center

- What’s a Bad Credit Score?

- How Credit Impacts Your Day-to-Day Life

Image: iStock

You Might Also Like

May 30, 2023

Managing Debt

September 7, 2021

Managing Debt

December 23, 2020

Managing Debt