I’m one of those rare individuals (okay, geeks) who enjoys reading credit card agreements. Every once in a while I get a credit card offer that really stands out from the crowd. Yesterday, I got one in the mail that really caught my eye.

I’m one of those rare individuals (okay, geeks) who enjoys reading credit card agreements. Every once in a while I get a credit card offer that really stands out from the crowd. Yesterday, I got one in the mail that really caught my eye.

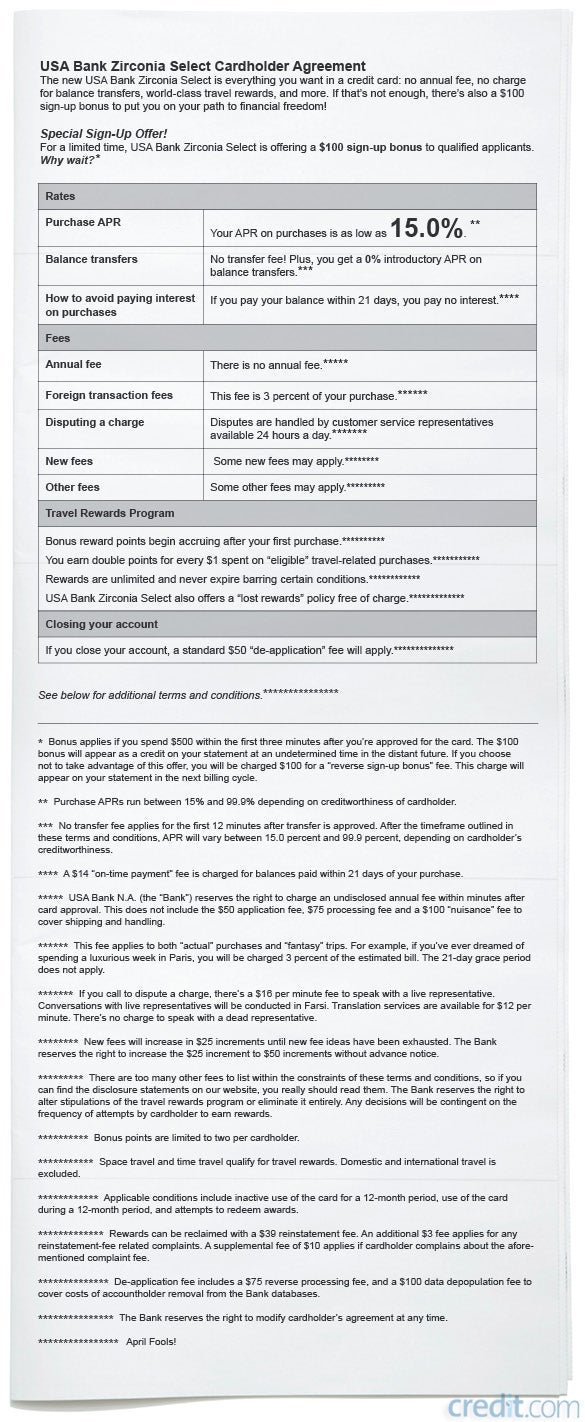

Here’s where it gets tricky. It looks like a pretty good offer—after all, that $100 sign-up bonus might be tempting to some—until you get to the fine print.

In fact, the USA Bank Zirconia Select agreement is a classic example of why you should always read the fine print of your credit card agreements. Any number of surprises could be lurking there, and usually not the good kind.

[Resource: The Credit CARD Act—Enhanced Consumer Disclosures]

Since the passage of the Credit CARD Act, your credit card issuer is required to provide easy online access to the cardholder agreement for your account. And even though the Center for Responsible Lending found that credit card agreements have been getting simpler, it’s all relative.

Let this be a lesson: read the credit card agreement before you sign the application, unless you want to end up with a card like this one.

Click to enlarge and read these shocking credit card terms!

Tell us, what’s the most absurd condition you’ve found lurking in the fine print of your credit card agreements?

[Credit Card Roundup: Credit Cards with Good Intentions]

Image: Credit.com

You Might Also Like

April 9, 2024

Credit Cards

October 21, 2020

Credit Cards

August 3, 2020

Credit Cards